What's the difference between a Credit Union and Bank?

Home > About U1 > What's the difference between a Credit Union and Bank?

Home > About U1 > What's the difference between a Credit Union and Bank?

The Credit Union Difference

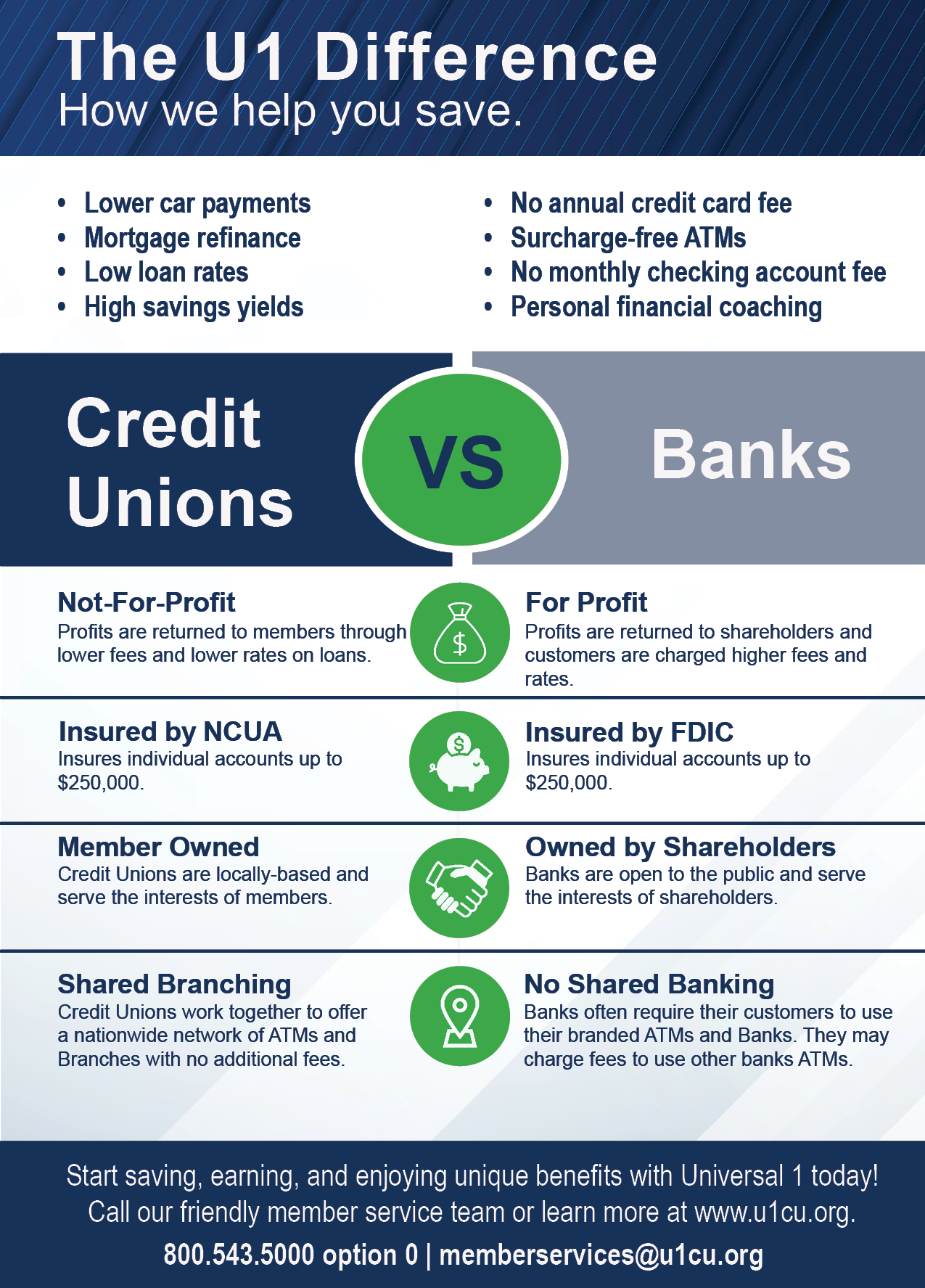

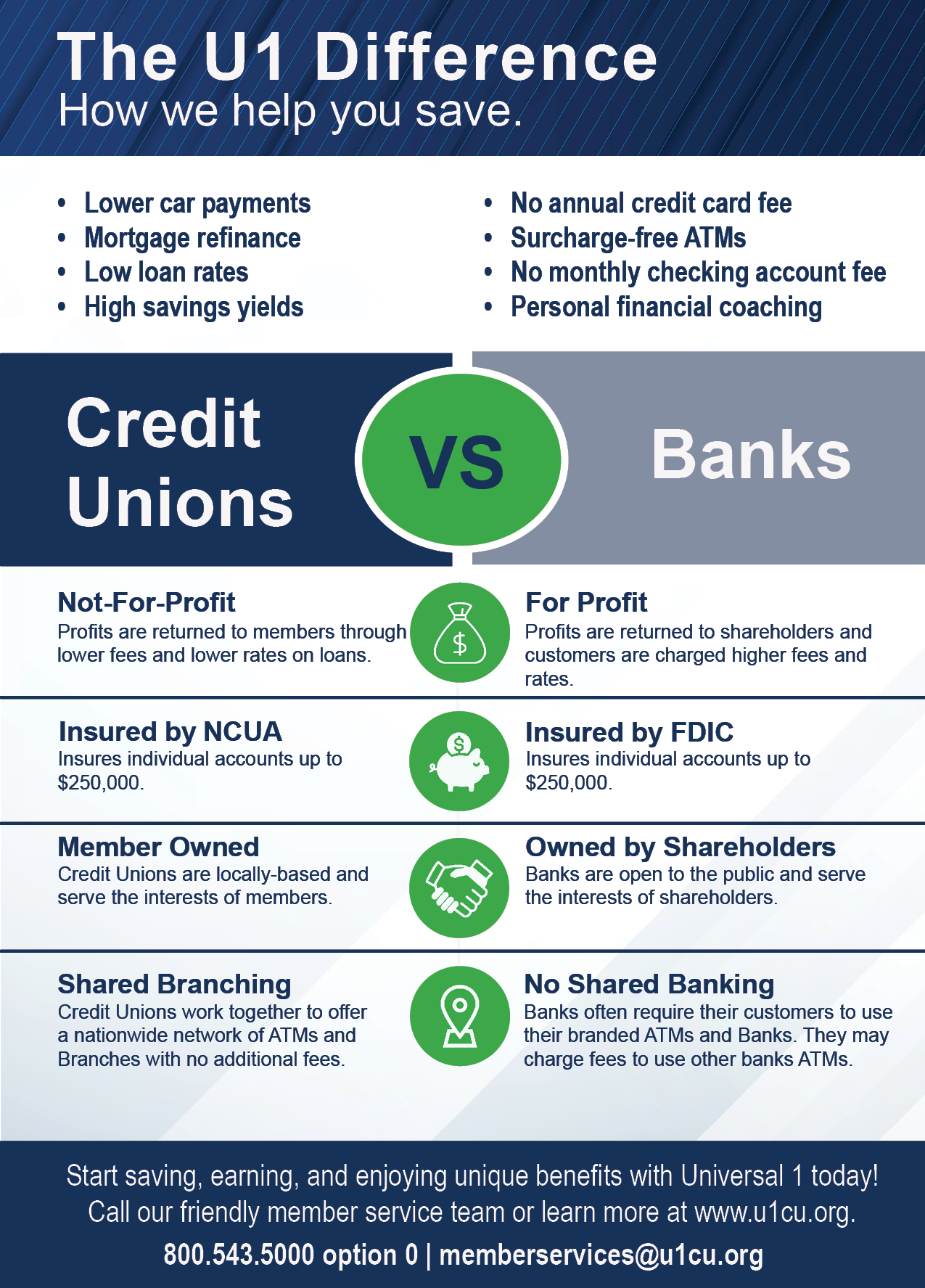

Authored By: U1CU on 7/10/2023 If you’re wondering about the difference between a credit union like U1 and a bank, it’s quite simple, credit unions are not-for-profit financial institutions that exist to promote personal, community, and financial well-being. At U1, we prioritize our members’ financial lives by providing them with the best possible experience. As a member, you’ll receive personalized service and one-on-one attention because we put people before profits.

In fact, at U1, you’re not just another customer – you’re a member and an owner. Our not-for-profit model means that we return funds to all member-owners in the form of dividends and lower rates. Regardless of the products you choose to use, such as savings, checking, individual retirement accounts (IRAs), or health savings accounts (HSAs), your funds are insured by the National Credit Union Administration (NCUA).

What is the NCUA?

The NCUA is an independent agency of the U.S. government that regulate, charters, and supervises credit unions. It also operates and manages the National Credit Union Share Insurance Fund (NCUSIF), which insures the accounts of millions of account holders with credit unions nationwide. The NCUSIF is backed up by the full faith and credit of the U.S. government, providing peace of mind for U1 members. More information can be found at https://www.ncua.gov/

NCUA Vs. FDIC

The difference between NCUA and FDIC is the former insures credit union deposits, while the latter insures bank deposits. However, both organizations work similarly. In the event of a credit union failure, the NCUA and FDIC insurance amounts are $250,000 per account owner, per insured credit union, for each account ownership category. Joint account ownership is insured for up to $250,000 per member, a total of $500,000.

Credit unions like U1 are also highly invested in local communities and often partner with local businesses through chamber of commerce interactions. With an all-volunteer board of directors, credit unions have local decision-makers and offer a full range of products and services, including personal financial advisors to help with investments and retirement planning, as well as conducting in-person seminars.

Products & Services include but are not limited to:

Products & Services

Membership Eligibility

U1 Membership eligibility is available through many outlets:

- If you belong to a select Employee Group (SEG) or work with one of our company partners, you’re eligible.

- If you have a family member with a U1 account.

- If you live, work, worship or attend school in a city or local county where U1 offers eligibility. See a list of cities and countries here.

Credit unions like U1 exist to serve their members and promote their financial well-being with a wide-range of products and services. As a member-owner, you can rest assured that your funds are insured by the NCUA, and you have a say in the decision-making process through the all-volunteer board of directors. For additional information, Visit our eligibility page.

« Return to "Blog"

Go to main navigation