Turn Your Home's Equity Into Opportunity

Use Your Home’s Equity to Strengthen Your Finances

Owning a home is more than just putting down roots—it’s an opportunity to build equity and improve your long-term financial health. At Universal 1 Credit Union (U1), we believe that understanding how equity works—and how to use it strategically—can open the door to new possibilities.

Let’s explore how paying off your mortgage faster, using a home equity line of credit or home remedy loan, and refinancing at the right time can help you make the most of your investment.

Build Equity Faster by Paying Down Your Mortgage

In the early years of a mortgage, a larger portion of your monthly payment goes toward interest instead of the loan’s principal. But by increasing your payments—even just slightly—you’ll begin to chip away at the principal faster and reduce the amount of interest you’ll pay overall.

Here’s a simple tip: making just one extra mortgage payment per year could take years off the life of your loan and save you thousands in interest.

Tap Into Your Equity with a Home Equity Line of Credit (HELOC)

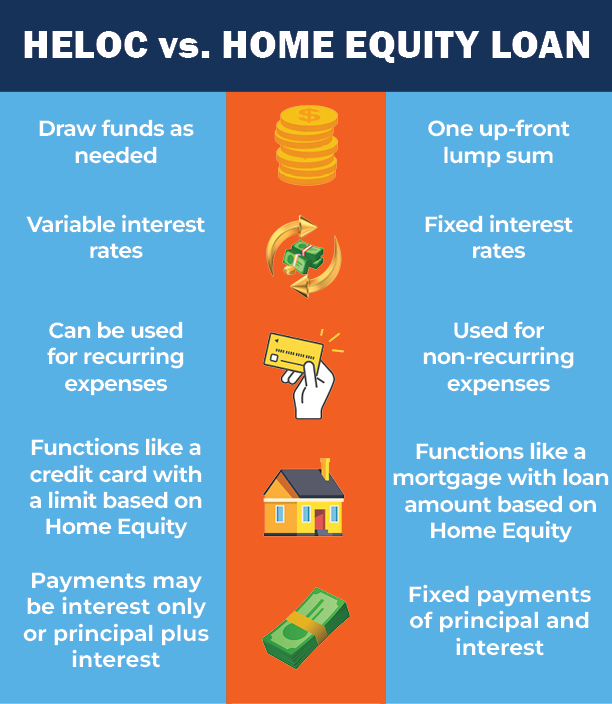

A home equity line of credit is a flexible way to access the equity you've built. Once approved, you can borrow up to a certain limit as needed—making it ideal for ongoing expenses like home repairs, medical bills, or even emergencies.

HELOCs work like a credit card with a variable interest rate, and you only pay interest on the amount you use. Just keep in mind that upfront costs may apply, and if you decide to sell your home, the line of credit must be paid in full. Also, leasing your home may not be allowed under some HELOC agreements, so review your terms carefully.

Finance Major Expenses with a Home Equity Loan

If you’re planning for a one-time expense—like college tuition or a major renovation—a home equity loan might be a better fit. It provides a lump sum at a fixed interest rate, offering predictable payments over time.

Because it’s secured by your home, a home equity loan typically offers lower rates than credit cards or personal loans. If you’re carrying high-interest debt, consolidating it with a home equity loan could save you money and help simplify your payments. Bonus: interest may be tax deductible (check with your tax advisor).

Refinance Your Mortgage and Save

If interest rates have dropped since you took out your mortgage, refinancing could lower your monthly payment and reduce the total interest paid over the life of the loan. As a rule of thumb, refinancing may be worth exploring if you can lower your interest rate by 2% or more.

Before making the move, weigh closing costs and consider how long you plan to stay in your home. Refinancing might make sense even if you don't stick with your original lender—just be sure to shop around and compare offers.

Let’s Talk About What’s Right for You

Everyone’s financial journey is different. At U1, we’re here to help you make informed decisions about your home, your equity, and your future. Whether you're looking to pay down your mortgage faster, access your equity, or refinance your loan, we’re here to guide you every step of the way.

Ready to explore your options? Contact us today to start the conversation.

memberservices@u1cu.org | 800-762-9555 ext 424 | https://www.u1cu.org/home-equity | NMLS #652486

Source: Practical Money Skills, https://www.practicalmoneyskills.com/en/learn/life_events/buying_a_home/home_equity.html, Title: Home Equity, Accessed: May, 6, 2025

This information is for informational purposes only and is intended to provide general guidance and does not constitute legal, tax, or financial advice. Each person’s circumstances are different and may not apply to the specific information provided. You should seek the advice of a financial professional, tax consultant, and/or legal counsel to discuss your specific needs before making any financial or other commitments regarding the matters related to your condition are made.

« Return to "Blog"