What Is A Credit Score And Why Is It Important?

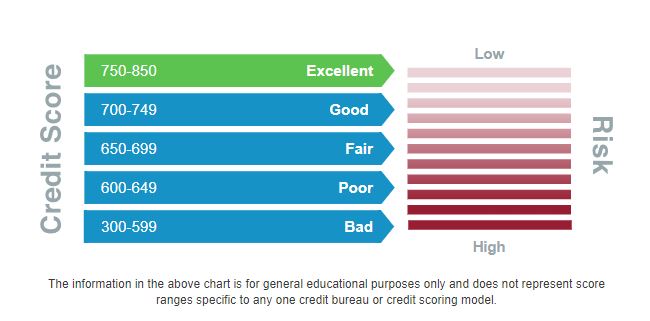

Your credit score, usually between 300 and 850, is a prediction of your creditworthiness – indicating how likely you are to repay a loan on time. A credit score gives lenders a brief overview of your repayment history and ability to repay loans. A high credit score suggests to financial institutions that you will make timely loan payments. A low credit score indicates that there is a higher risk that you will not repay a loan. Your credit score can affect not only if you can qualify for a loan, but also the interest rate you may pay on the loan.

The average American’s credit score was around 715 in 2023, according to Experian1. So, if you have at least a 700 score, you’re doing alright. If you are below 700, however, there is room for improvement. Don’t worry, because with a few steps and habits you can improve your score and work your way up to great credit and even better financial wellbeing.

What is considered a good credit score?

Although ranges vary depending on the credit scoring model, scores between 670-739 is generally considered good.

The popular FICO2 score, used by many lenders, places individuals into five categories:

- 800 and above – Exceptional

- 740-799 - Very Good

- 670-739 – Good

- 580-669 - Fair

- 579 and below - Poor

What affects my credit score?

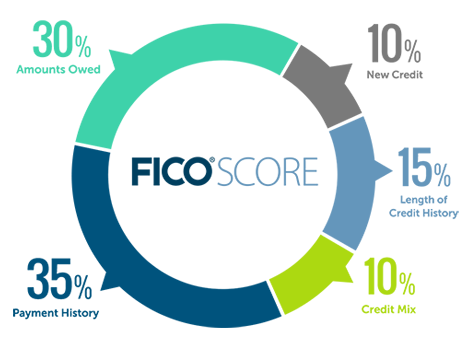

There are five key factors that play a role in determining your score, representing different aspects of your financial habits and accountability. Understanding how these factors affect your credit score is essential for effectively managing and improving it in the long run.

- Payment history 35%: This reflects the history of your payments, whether you've consistently paid bills and other obligations on time. In general, on-time payments will improve your credit score.

- Credit utilization 30%: The amount of credit you’re using compared to your limits. For example, if you have a $6,500 balance on a credit card that has a $10,000 credit limit, your credit utilization ratio is 65%. In general, the utilization ratio should be between 10%-30% on all your credit cards. If you get to 50%, request a credit limit increase.

- Length of credit history 15%: The longer the history of responsible credit usage, the better. It shows a track record of being able to manage credit well.

- Types of credit 10%: Having a variety of credit types, such as installment debt (auto loans and mortgages) and revolving credit (credit cards and home equity lines of credit) can benefit your score.

- New credit inquiries 10%: Whenever you apply for credit, it triggers a "hard" inquiry on your credit. A hard inquiry, occurs when a lender checks your credit report as part of the loan application process. Too many inquiries in a short period of time could temporarily decrease your score.

How can I improve my credit score?

There are several ways to improve your credit score, including:

- Paying bills on time: Establish a consistent payment history by ensuring all bills and debts are paid by the due date.

- Reducing debt levels: Work on lowering your overall debt, especially on credit cards. To maintain a good or excellent credit score, it's best to aim for a credit utilization ratio below 30%.

- Limiting new credit applications: Only apply for new credit when necessary. Each application can result in a hard inquiry which might temporarily lower your score.

With numerous factors affecting your credit score, navigating the path to a healthy financial future can be overwhelming. That's why the experts at U1 are here to help. Schedule an appointment today to learn more about understanding and improving your credit score.

Check your credit report

You are allowed to request one free credit report from all three major credit bureaus3 once a year, so take advantage and request a report. Once you receive it, take a good look to make sure it is completely free of any errors that may be bringing down your credit. If you do find errors, you can fix them following these steps provided by the Federal Trade Commission4.

Understanding and managing your credit score is important for your financial health. By using new credit wisely and practicing healthy credit habits, you can gradually boost your score. This can lead to better loan terms and interest rates. Begin making small changes today for a more stable financial future.

If you currently have high-rate credit cards or loans, call a member service representative at 800-762-9555 opt. 0. We will help determine if we can save you money by refinancing high-cost loans.

Schedule an appointment | memberservices@u1cu.org | 800-762-9555 opt. 0 | U1 Locations

This information is for informational purposes only and is intended to provide general guidance and does not constitute legal, tax, or financial advice. Each person’s circumstances are different and may not apply to the specific information provided. You should seek the advice of a financial professional, tax consultant, and/or legal counsel to discuss your specific needs before making any financial or other commitments regarding the matters related to your condition are made.

1 https://www.myfico.com/credit-education/credit-scores

2 https://www.experian.com/blogs/ask-experian/what-is-the-average-credit-score-in-the-u-s/

3 https://www.ftc.gov/faq/consumer-protection/get-my-free-credit-report

4 https://www.consumer.ftc.gov/articles/0151-disputing-errors-credit-reports

« Return to "Blog"