U1 System Upgrade

Home > U1 System Upgrade

Home > U1 System Upgrade

We Are Getting An Upgrade, And So Are You!

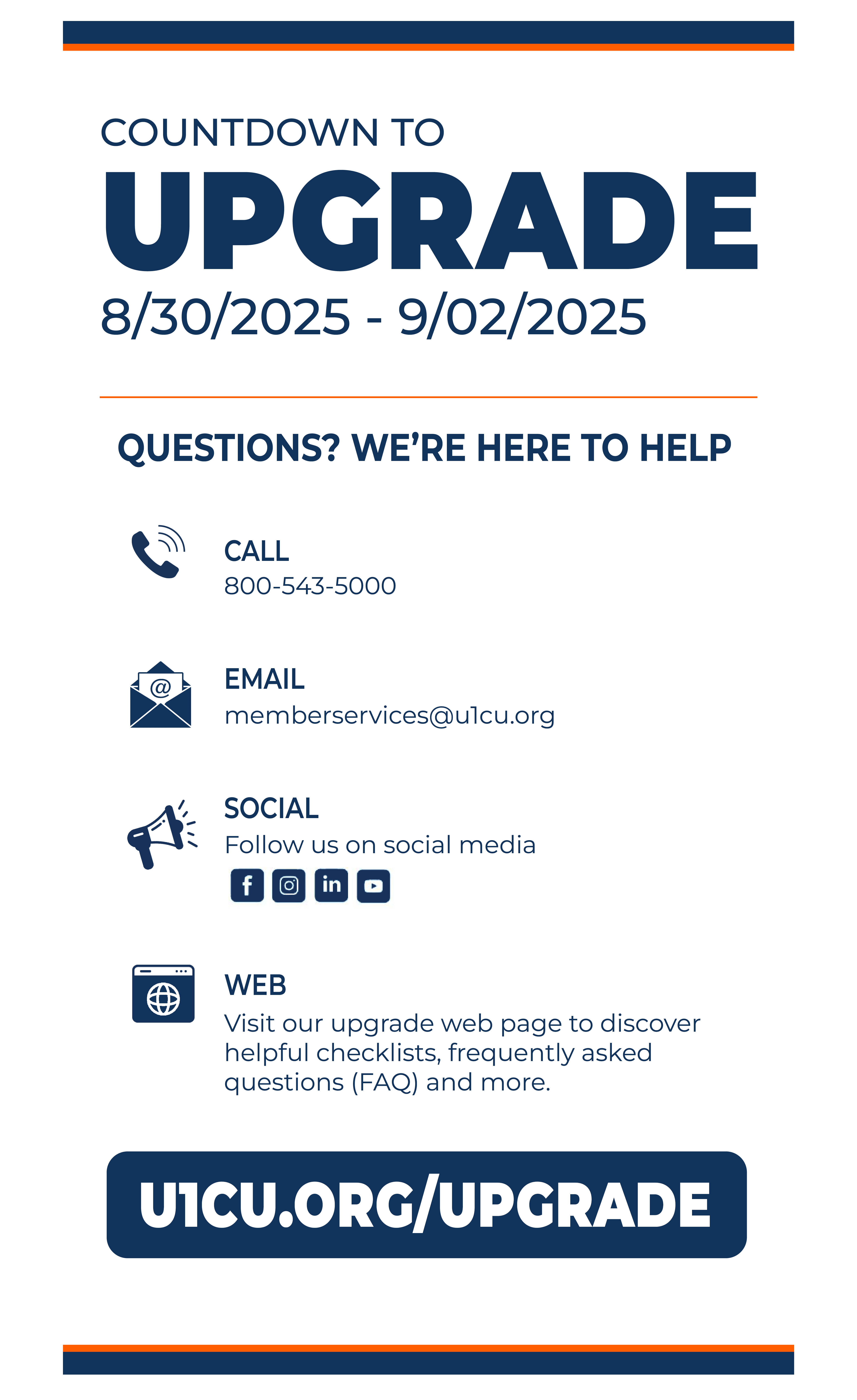

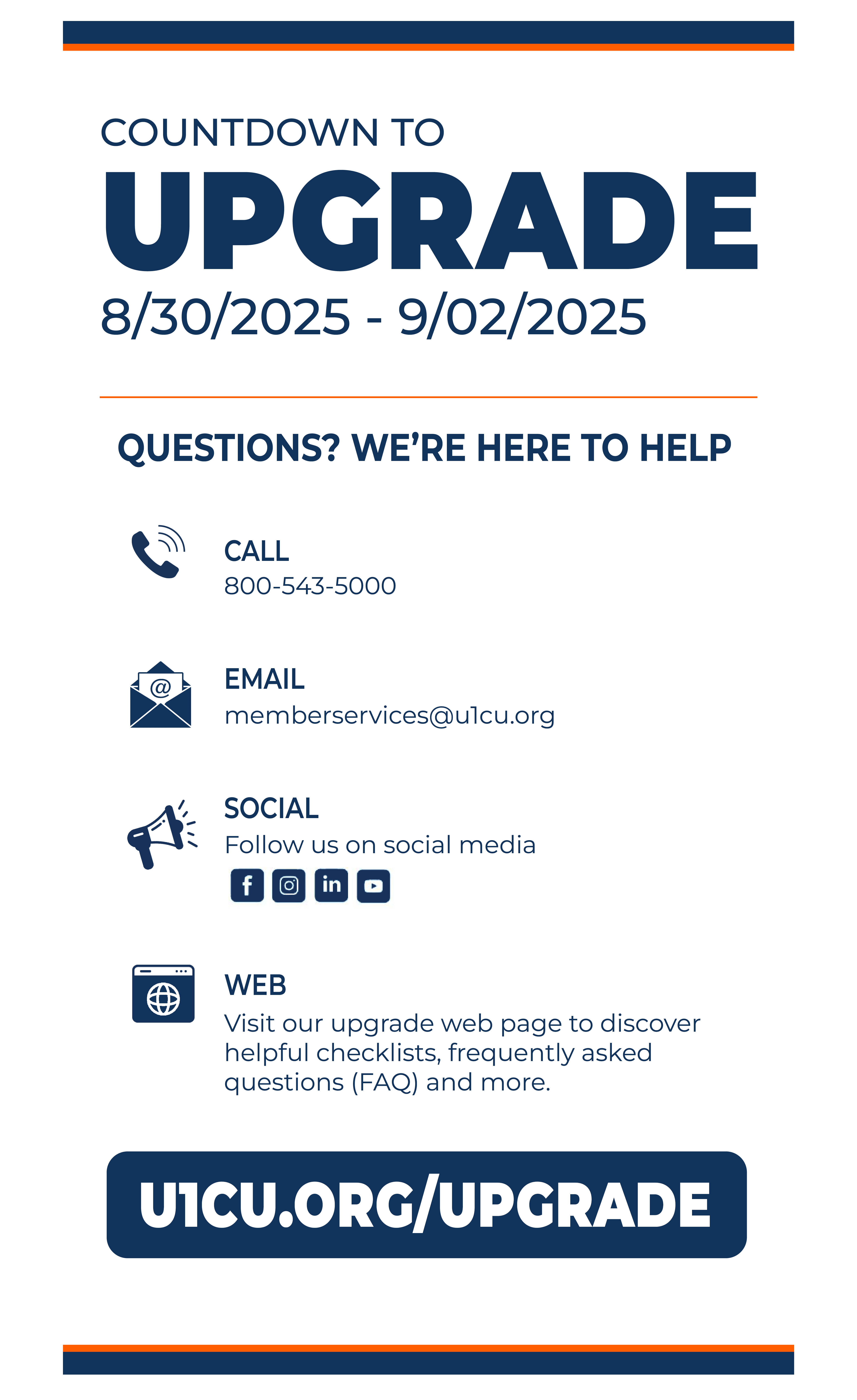

We are pleased to announce that effective September 2, 2025, Universal 1 Credit Union (U1) will be upgraded to a new core operating system. This extensive project will wrap up on Labor Day weekend, August 30 - September 2, 2025, marking a major step forward in our commitment to remain at the forefront of banking technology. The System Upgrade will enhance account openings, streamline branch transactions and deliver an even better overall experience.

This page will be your go-to source for everything related to the System Upgrade. You’ll find key dates and times, including Service Center closures, expected downtimes, and steps you can take to prepare for the upcoming changes. Take a moment to review the information and resources on this page carefully. If you have any questions, please feel free to contact our Member Service team.

memberservices@u1cu.org | 800.543.5000 option 0

MENU

Click the menu options below to be taken to a particular section or download the PDF version

FAQs

Review our Frequently Asked Questions regarding our System Upgrade.

Learn More

Online Banking Updates

Learn what enhancements and changes are coming to U1 Online and Mobile Banking after the System Upgrade.

Learn More

What's staying the same?

Back to menu

Throughout the many months of preparation for upgrading to a new system, our fundamental goal has been to limit the impact on our members. We have worked diligently to make the transition as seamless as possible. As a result, the items below will remain the same after the System Upgrade.

Member Account Numbers: Will remain the same.

Online & Mobile Banking Username and Password: Will remain the same, however, for members with multiple accounts with separate usernames and passwords, only the oldest one will be kept.

All existing U1 VISA Debit and Credit Cards: Will stay the same after the upgrade. All existing Personal Identification Numbers (PINs) will remain the same.

Automated Deposits and Withdrawals: Deposits and withdrawals already scheduled will continue without interruption.

All Existing Mobile Payment Services or Digital Wallets: Apple Pay®, Google Pay® or Samsung Pay® will continue to function as they normally do.

Direct Deposits: Will not be affected.

U1's Routing/Transit Number: Will remain the same.

All Scheduled Deposits, Transfers and Payments: Will continue without interruption. The time of day that the above activities process may change.

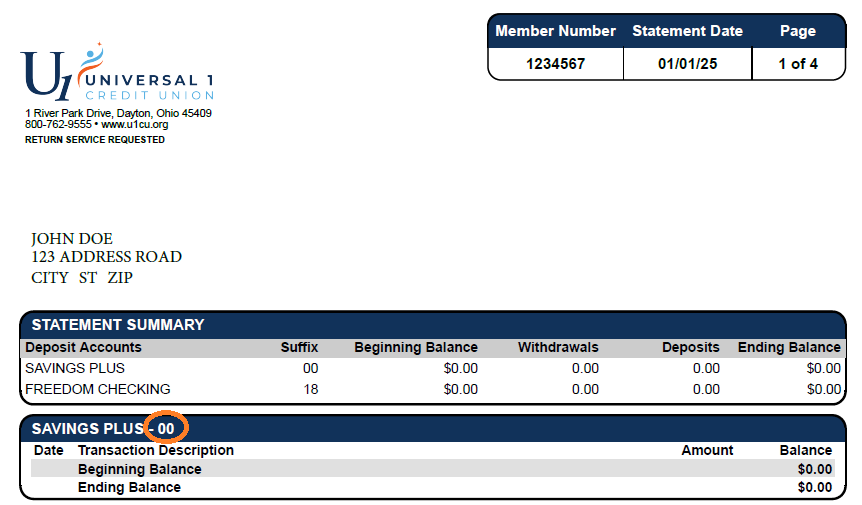

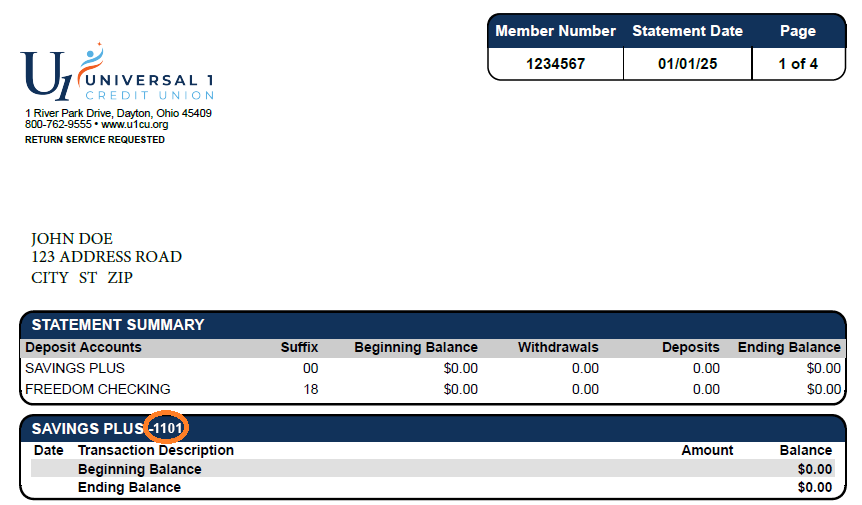

Account Statements: Will remain the same, however, members will receive two statements - one for transactions before the upgrade, and another for transactions during and after the upgrade. The new statements will be in a consolidated format with all the accounts your associated with.

Check ID Number: The number printed on checks will not change and members may continue to use current/existing supply of personal and business checks.

Bill Pay: Our Bill Pay system will remain the same and everything will transfer over. Existing payees will remain the same and all previously scheduled payments will continue to process as usual after the System Upgrade weekend.

Any Online Banking/Bill Pay items scheduled to be paid between August 29 and September 1 will be processed on September 2, once the System Upgrade is complete.

What's new?

Back to menu

To support members through the upcoming transition, we’ve outlined key changes taking effect after the System Upgrade. Please review the following information carefully to stay prepared.

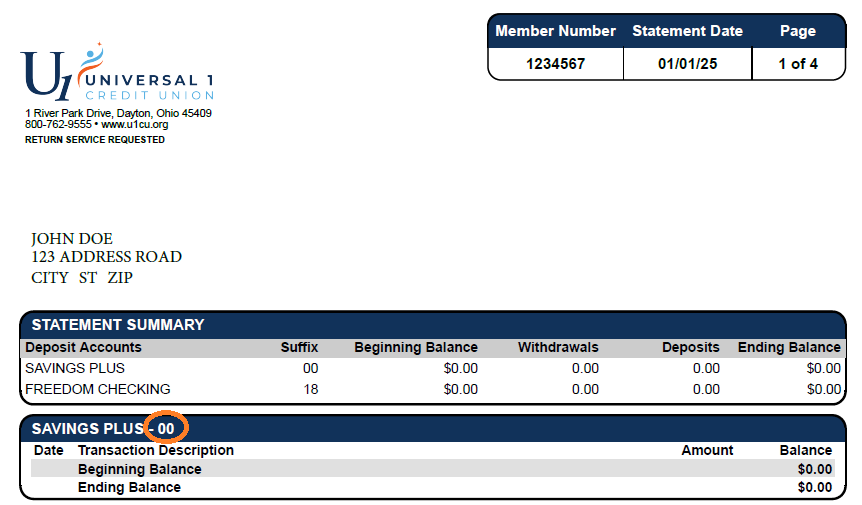

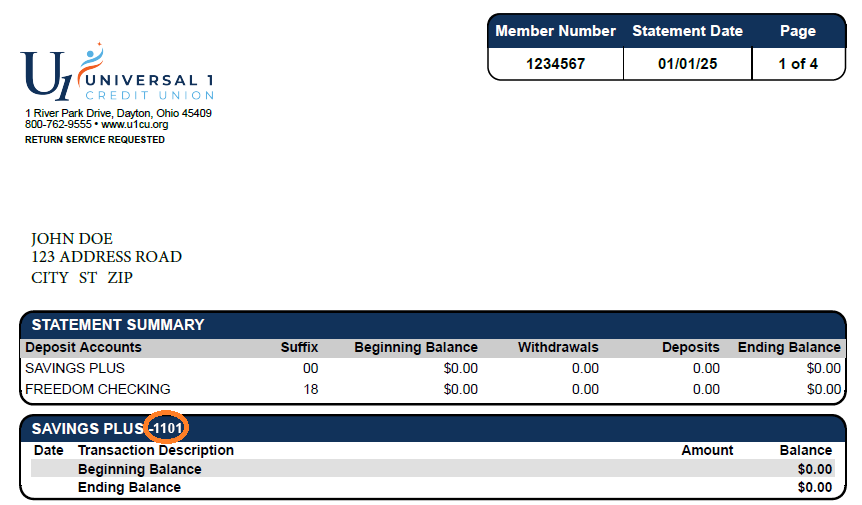

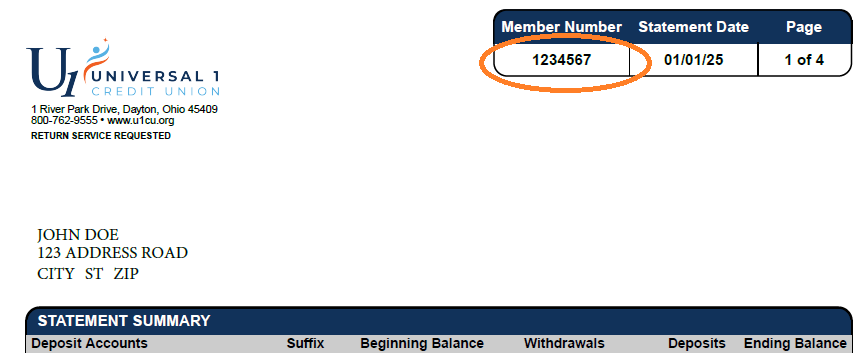

Member Number Suffix:

Account numbers will remain the same, however, your suffix will now include four digits instead of two. Currently, the suffix number is the last two digits following your main account number, which indicates the account type, like Savings or an Auto Loan. For example, if your account is ‘1234567-89’, it will become ‘1234567-1101’. Below is a sample of both a current and new statement, with the suffix circled.

Call 24 Services (Audio Banking):

When calling our Call 24 services for the first time after the System Upgrade, members will be prompted to provide personal information and reset their PIN number. Members will be able to reset to the same PIN as before. The Call 24 number will remain the same: 937-225-9401

Online Banking Enhancements:

Simplified Access: Members who currently manage multiple member accounts with separate usernames and passwords will now see all their accounts consolidated under one login. The login with the oldest member account will be retained as the primary, and all associated accounts will be accessible through that single username and password. This will allow members to manage all of their accounts in one place without needing to sign into each individual account.

Primary account owners who are also a joint owner on an account under a different member number will see a consolidated view of those accounts within Online and Mobile Banking.

Unified View: Online & Mobile Banking dashboards will feature a new look and feel, offering easier navigation and customization options - such as tagging favorite accounts, reordering views and managing widgets - all in one place!

Visit the Online Banking Updates page for complete details on the enhancements. The page includes navigation tutorials and a preview of what to expect when logging in to Online or Mobile Banking after the System Upgrade.

Please note: Money Management will not be available until September 3, 2025 after the System Upgrade

Steps you can take now or before

Back to menu

Please be sure to complete these simple steps before 5:00 pm on Friday, August 29th to help minimize any potential inconveniences and/or interruptions to your day-to-day banking.

1. Verify Your Contact Information

Log in to your Online or Mobile Banking account and click/tap “My Settings” to edit contact information.

Note: “My Settings” can be accessed by tapping the gear icon () on the Mobile App.

Alternative method: Visit any U1 Service Center, call or email our Member Services team to update contact information.

memberservices@u1cu.org | 800.543.5000 option 0

2. Mark Your Calendar

The System Upgrade will take place over Labor Day Weekend: 08/30/25 - 09/02/25

Online and Mobile Banking access will be unavailable during this time and U1 Service Centers will be closed from Saturday, August 30th to September 1st, with a delayed opening on Tuesday, September 2nd at noon.

3. Stay Informed

We will be keeping members up-to-date on all important upgrade details through email, mail, and Online/Mobile Banking notifications. Emails will come from memberservices@u1cu.org. Please check your spam folder if you haven’t seen any messages, or contact us to resubscribe if needed.

4. Add Account Nicknames (by 5:00 pm on Friday, August 29, 2025)

We recommend giving your accounts nicknames prior to the System Upgrade. This will help easily recognize them after the upgrade. Follow the steps below to create nicknames.

- Online Banking: Go to “My Settings” and then “Rename & Hide your accounts” under “Other settings” at the bottom of the screen.

- Mobile Banking: Tap the gear icon () and then “Account Preferences”. Once on that page, tap “Edit” and change the name.

Account numbers will still be visible, even after adding a nickname.

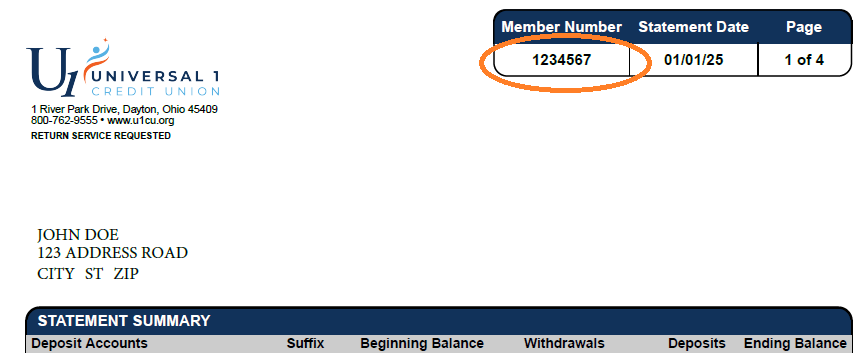

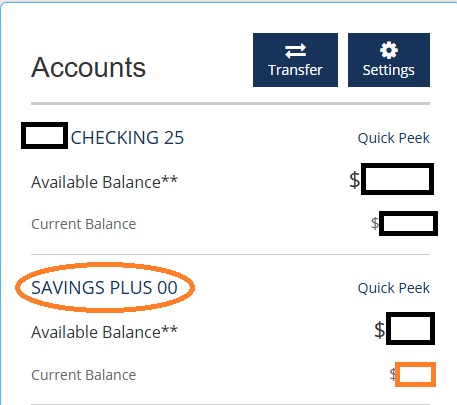

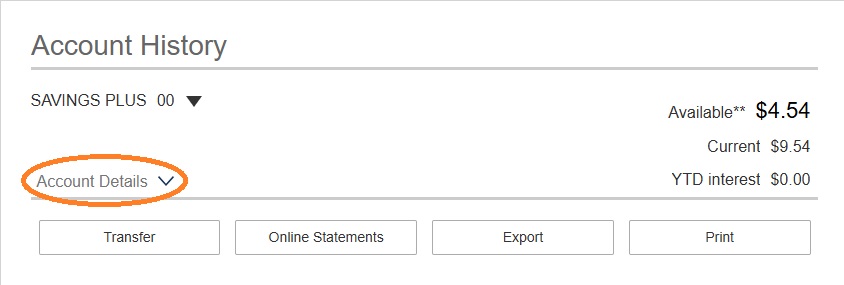

5. Know Your Member Account Number

After the upgrade, if you have multiple member accounts at U1, your Online Banking username and password will be tied to your oldest account number - the one that’s been active the longest. Don't worry, you're not losing any accounts. All of your accounts will now be viewable under one Online Banking login and combined on one statement.

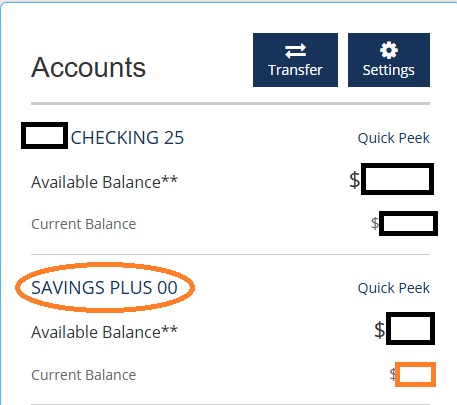

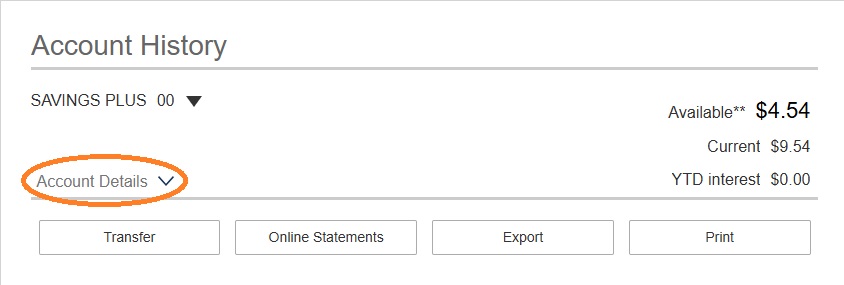

If you’re unsure what your member number is, you can locate it in Online Banking or on your statement (see screenshots below). To view this within your Online Banking account, log in to Online Banking, under “My Accounts”, click your main Savings account. You’ll be taken to the Account History page and there you will see a dropdown menu titled: “Account Details”. Click that and locate the ACH number for your full account number. If you cannot find it, please visit a Service Center, email or give us a call.

6. Complete Transactions (by 5:00 pm on Friday, August 29, 2025)

Deposits: Mobile Check, ATM or Service Center Deposits

Transfers: Schedule or complete any manual transfers. Any automatic deposits, withdrawals, transfers or payments already scheduled will still go through as usual - just as they would on a normal holiday weekend.

Travel Plans: Notify U1 if traveling out of state.

In-Branch Needs: Complete any special in-branch transactions.

Cash Access: U1 Debit Cards will work as normal for purchases and ATM withdrawals, but consider having extra cash on hand. If planning large purchases, try to make them before

the upgrade.

Note: U1 Credit Cards will not be affected during the upgrade.

During Labor Day weekend

Back to menu

Below are some important dates and times to keep in mind During Labor Day Weekend (08/30/25 - 09/02/25)

U1 Service Centers

Closed on Saturday, August 30, 2025

Closed on Sunday, August 31, 2025

Closed on Monday, September 1, 2025 for Labor Day

Delayed opening on Tuesday, September 2nd and reopen at noon

Online & Mobile Banking

Unavailable from 5:00 pm Friday, August 29th to Tuesday, September 2nd.

We anticipate access to be restored by Tuesday afternoon on September 2nd.

U1 Member Support

Member Support (phone & email) will be unavailable from 5:00 pm Friday, August 29th to 12:00 pm Tuesday, September 2nd.

Below is a breakdown of services available and unavailable during Labor Day Weekend.

| WHAT'S AVAILABLE |

WHAT'S NOT AVAILABLE |

- U1 Credit Cards: Will work as normal

|

- U1 Service Centers: Will be closed this weekend.

|

- U1 ATMs: During this weekend, ATMs will be available for cash withdrawals only.

|

- U1 Online and Mobile Banking: Will not be accessible this weekend.

|

- Debit Cards: Card transactions, including ATM withdrawals, will post to your account after the upgrade weekend.

|

- U1 Member Support (phone & email): Will be unavailable.

|

- Loan & Mortgage applications: Will still be available and function normally.

|

- Call 24 services: Will not be available

|

- Loan Payments: Payments scheduled to occur during the upgrade will be processed as soon as the System Upgrade is completed.

You will not be able to set up new loan payments or cancel existing payments during the upgrade weekend.

|

- U1 Bill Pay: Setting up and/or cancelling payments will not be available during the System Upgrade. All existing scheduled bill payments will operate normally and be processed as planned.

|

- Direct Deposit: All previously scheduled automatic deposits, withdrawals, transfers, and payments will still go through as usual - just like they would on a normal holiday weekend.

|

- ATM and Debit Card: Access will work, however, ATM access to account balances and transfers will not be available during this weekend. Balances will not update.

|

- Night Drop Boxes: Items placed in the Night Drop Box will be posted by the close of business on Tuesday, September 2nd.

|

- Shared Branching: Members will not be able to access their account or conduct any transactions at shared branches during this weekend.

|

|

|

- Money Management, QuickBooks & Quicken: Will be unavailable. Money Management will not be available until September 3, 2025 after the System Upgrade.

|

Back to menu

Go to main navigation